net investment income tax 2021 trusts

Investment tax credit that you. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

Tax Advantages For Donor Advised Funds Nptrust

2022-08-08 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of.

. The IRS gives you a pass. Download or print the 2021 Federal Form 8960 Net Investment Income Tax - Individual Estates and Trusts for FREE from the Federal Internal Revenue Service. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. Calculating NIIT is not just as simple as multiplying your net investment earnings by 38. The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes 250000 for single filers and.

Individuals with MAGI of 250000 married filing jointly or 200000 for single filers are taxed at a flat rate of 38 percent on investment income such as dividends. Generally net investment income includes gross income from interest dividends annuities and royalties. The estates or trusts portion of net investment income tax is calculated on Form.

Original filing and payment due date of the 2021 tax year April 15 2022 for calendar-year filers but is. As a result any net investment income generated by the trust is included in the grantors net investment income potentially subject to the 38 tax at the individual level. 1 It applies to individuals families estates and trusts.

It is clear from the statutory. The 38 tax on net investment income also applies to undistributed trust income so it is just as important for trusts to avoid passive characterization. You are charged 38 of the lesser of net investment income.

Effective January 1 2013 Code Sec. Step 6 Figure your net income tax - For trusts and.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

What You Need To Know About Capital Gains Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

News Articles Preservation Trust Company

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Innovations In Tax Compliance Building Trust Navigating Politics And Tailoring Reform

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Understanding The New Kiddie Tax Journal Of Accountancy

Turbotax Business Cd Download 2021 2022 Desktop Software File Business Taxes

Investor Education 2022 Tax Rates Schedules And Contribution Limits

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

How To Analyze Reits Real Estate Investment Trusts

Net Investment Income Tax Niit The Accounting And Tax Canada

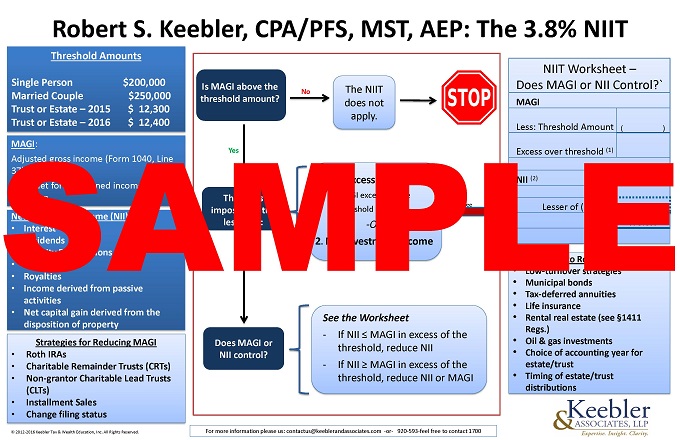

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Grant Distribution Summary Nina Mason Pulliam Charitable Trust

Income Taxation Of Trusts And Estates After Tax Reform

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Calculating Additional Tax On The Sale Of S Corp Stock Windes